Deciphering the World of Foreign Exchange Trading: Uncovering the Importance of Brokers in Making Sure and managing threats Success

In the elaborate world of foreign exchange trading, the function of brokers stands as a crucial element that usually remains shrouded in enigma to several aspiring traders. The value of brokers exceeds mere deal assistance; it reaches the realm of danger management and the general success of trading undertakings. By leaving brokers with the task of browsing the complexities of the forex market, traders can possibly unlock a world of opportunities that might or else remain elusive. The intricate dance in between brokers and traders reveals a symbiotic connection that holds the vital to unwinding the enigmas of profitable trading ventures.

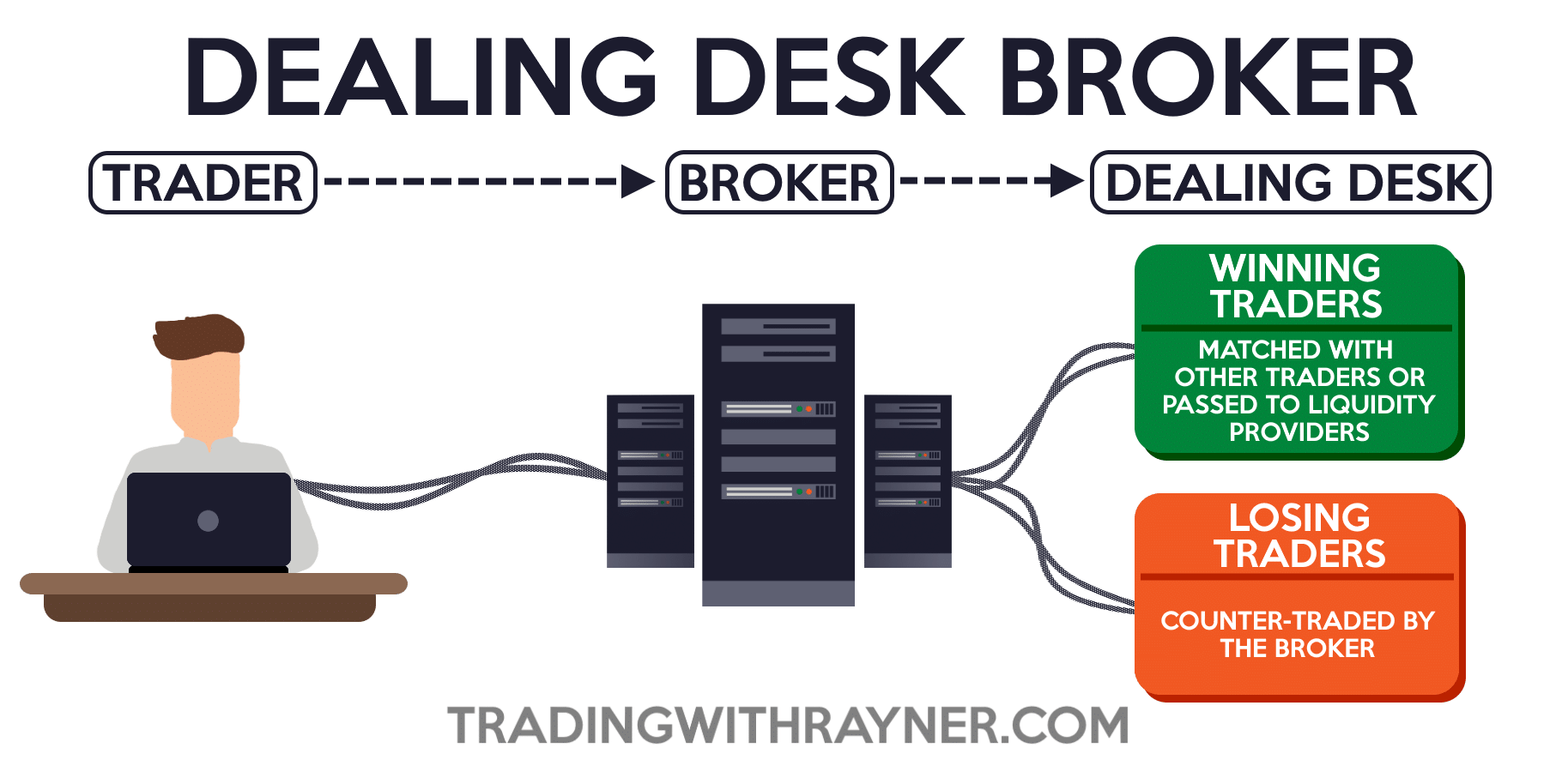

The Duty of Brokers in Foreign Exchange Trading

Brokers play a vital function in foreign exchange trading by supplying vital services that aid investors handle dangers efficiently. One of the main features of brokers is to offer investors with access to the market by facilitating the execution of professions.

Furthermore, brokers provide leverage, which allows investors to control bigger positions with a smaller quantity of capital. While leverage can intensify earnings, it also boosts the potential for losses, making risk management vital in foreign exchange trading. Brokers give risk management tools such as stop-loss orders and restriction orders, permitting traders to set predefined exit factors to reduce losses and safe and secure earnings. In addition, brokers supply academic resources and market evaluation to help traders make notified decisions and create reliable trading strategies. Generally, brokers are indispensable partners for traders aiming to browse the foreign exchange market successfully and handle threats properly.

Threat Management Techniques With Brokers

Offered the essential role brokers play in assisting in accessibility to the foreign exchange market and providing danger administration tools, understanding effective strategies for managing risks with brokers is important for successful foreign exchange trading. One vital approach is establishing stop-loss orders, which permit investors to determine the optimum amount they want to lose on a trade. This device assists restrict prospective losses and safeguards against adverse market activities. An additional crucial risk management approach is diversity. By spreading out financial investments throughout different currency pairs and possession courses, investors can decrease their exposure to any type of single market or tool. In addition, using take advantage of very carefully is crucial for danger administration. While leverage amplifies earnings, it also magnifies losses, so it is essential to utilize take advantage of sensibly and have a clear understanding of its implications. Keeping a trading journal to track performance, assess past trades, and determine patterns can aid investors refine their methods and make more informed decisions, inevitably boosting threat monitoring techniques in foreign exchange trading.

Broker Selection for Trading Success

Choosing the right broker is vital for accomplishing success in forex trading, as it can substantially impact the general trading experience and outcomes. When picking a broker, a number of essential aspects over at this website must be thought about to make sure a rewarding trading journey. One vital facet to review is the broker's regulatory compliance. Collaborating with a controlled broker offers a layer of protection for investors, as it ensures that the broker runs within established standards and criteria, thus reducing the risk of fraud or negligence.

Additionally, investors ought to analyze the broker's trading system and tools. Examining the broker's customer assistance services is essential.

Moreover, investors must evaluate the broker's cost structure, including spreads, commissions, Website and any kind of concealed costs, to comprehend the price ramifications of trading with a particular broker - forex brokers. By very carefully assessing these factors, investors can select a broker that lines up with their trading objectives and sets the stage for trading success

Leveraging Broker Competence commercial

Exactly how can investors effectively harness the know-how of their picked brokers to optimize profitability in forex trading? Leveraging broker proficiency for profit needs a strategic technique that includes understanding and making use of the services provided by the broker to enhance trading results.

In addition, traders can gain from the assistance and assistance of skilled brokers. Developing a good connection with a broker can result in personalized recommendations, profession suggestions, and risk management approaches customized to private trading styles and objectives. By interacting frequently with their brokers and seeking input on trading strategies, investors can take advantage of experienced expertise and enhance their overall performance in the forex market. Ultimately, leveraging broker competence for profit entails active engagement, constant learning, and a collective technique to trading that optimizes the potential for success.

Broker Support in Market Analysis

Furthermore, brokers can offer prompt updates on economic occasions, geopolitical advancements, and other factors that might affect currency rates, making it possible for traders to remain in advance of market fluctuations and change their trading placements appropriately. Ultimately, by making use of broker support in market analysis, investors can improve their trading efficiency and enhance their chances of success in the competitive foreign exchange market.

Verdict

In verdict, brokers play a crucial duty in foreign exchange trading by handling dangers, providing knowledge, and helping in market analysis. Choosing the best broker is crucial for trading success and leveraging their expertise can lead to profit. forex brokers. By using risk administration approaches and working carefully with brokers, traders can browse the intricate globe of forex trading with confidence and boost their opportunities of success

Provided the vital function brokers play in promoting accessibility to the international exchange market and providing danger find more information monitoring tools, comprehending efficient approaches for taking care of risks with brokers is necessary for successful foreign exchange trading.Selecting the appropriate broker is paramount for accomplishing success in foreign exchange trading, as it can considerably influence the general trading experience and outcomes. Functioning with a regulated broker supplies a layer of security for traders, as it guarantees that the broker operates within set requirements and guidelines, thus lowering the danger of fraud or malpractice.

Leveraging broker know-how for profit needs a tactical approach that includes understanding and making use of the solutions offered by the broker to improve trading end results.To efficiently utilize on broker proficiency for revenue in foreign exchange trading, traders can count on broker support in market evaluation for informed decision-making and risk reduction strategies.